Looking for the best car insurance for high-mileage drivers? If you’re constantly on the road — whether for commuting, road trips, or business — this guide is for you. High-mileage driving offers freedom, but it can also lead to higher insurance premiums due to increased risk.

But that doesn’t mean you’re stuck paying more. With the right insurer and coverage strategy, high-mileage drivers can still find affordable, comprehensive car insurance. In this guide, we’ll break down the best options in 2025 and how to get the most value from your policy.

Why Mileage Matters in Car Insurance for High-Mileage Drivers

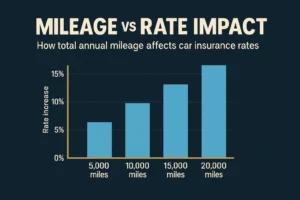

Insurance companies use mileage as a key rating factor. The more you drive, the higher your chances of being in an accident — which is why high-mileage drivers typically pay more than low-mileage drivers. On average, driving over 15,000 miles per year may raise your rate by 10–20%.

But not all insurers treat mileage the same — and some even offer discounts if you track your habits through a telematics program. Learn more about telematics insurance programs.

Best Car Insurance Companies for High-Mileage Drivers (2025)

1. Progressive

Why it works: Offers competitive rates for frequent drivers and discounts through the Snapshot® usage-based program. Ideal for commuters and rideshare drivers.

2. GEICO

Why it works: Known for affordability across most states. GEICO balances mileage with driving record, making it a solid choice for those with clean histories and long commutes.

3. State Farm

Why it works: Offers consistent pricing regardless of moderate mileage and rewards safe drivers through the Drive Safe & Save™ app — which also tracks mileage and driving behavior.

4. Allstate

Why it works: Drivewise® rewards mileage-conscious habits and offers extra benefits for frequent drivers who stay alert and safe behind the wheel.

5. Nationwide

Why it works: SmartRide® uses driving data to adjust rates, and even high-mileage drivers can save if they show safe patterns.

Coverage Tips for Car Insurance for High-Mileage Drivers

- Maintain comprehensive and collision coverage: The more you drive, the higher your exposure to damage and accidents.

- Consider higher liability limits: Especially important for highway-heavy drivers or those in commercial use.

- Keep up with maintenance: Insurers may deny claims due to mechanical neglect — track service history if you’re putting in serious miles.

- Ask about rideshare endorsements: If you drive for Uber or Lyft, you’ll need special coverage.

How to Save on Car Insurance for High-Mileage Drivers

- Use telematics or app-based programs to prove you’re a safe driver

- Bundle policies (auto + home/renters) for discounts

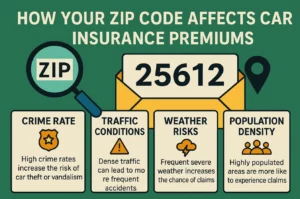

- Shop quotes every 6–12 months — rates can shift based on location and vehicle age

- Consider increasing your deductible for lower monthly premiums

- Enroll in a defensive driving course — especially if your mileage is related to work

Final Thoughts on Finding the Right Car Insurance for High-Mileage Drivers

Driving a lot doesn’t mean you have to overpay for car insurance. The best car insurance for high-mileage drivers balances affordability, reliability, and mileage flexibility. With the right insurer and smart policy choices, you can protect your vehicle and your wallet — no matter how far the road takes you.

Compare personalized quotes today and look for programs that reward smart, safe, and consistent driving habits — even when the miles add up.