Getting a car insurance quote under 25 can feel overwhelming — but it doesn’t have to be. While it’s true that drivers under 25 often face higher rates, there are proven strategies to save money and get covered without breaking the bank.

In this 2025 guide, we’ll explore why insurance is more expensive for young drivers, what you can expect to pay, and how to find the best car insurance quote under 25 for your situation.

Why Car Insurance Is More Expensive for Drivers Under 25

Insurance companies calculate premiums based on risk. Statistically, drivers under 25 are more likely to:

- Get into accidents

- File insurance claims

- Engage in risky driving behaviors

This added risk translates into higher quotes. On average, young drivers can pay up to twice as much as older, more experienced motorists.

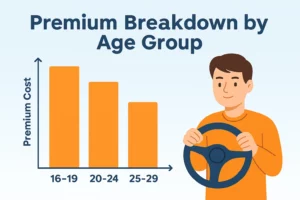

Average Car Insurance Quote Under 25 (2025)

- Ages 16–19: $250–$450/month (individual policy)

- Ages 20–22: $180–$300/month

- Ages 23–24: $140–$220/month

📌 Tip: Staying on a parent’s policy can reduce your premium by 50% or more.

Insurance Comparison for Drivers Under 25

| Age Bracket | Monthly Premium | Top Insurer | Popular Discounts |

|---|---|---|---|

| 16–17 | $300 – $450 | GEICO, USAA | Good Student, Family Policy |

| 18–19 | $250 – $400 | State Farm | Steer Clear®, Student Away |

| 20–22 | $180 – $300 | Progressive | Snapshot®, Multi-Policy |

| 23–24 | $140 – $220 | Nationwide | SmartRide®, Forgiveness |

Top Companies Offering Car Insurance Quotes Under 25

- GEICO: Best for good student discounts

- State Farm: Great for teen driver programs

- Progressive: Telematics help lower costs

- Nationwide: Safe driving rewards

- USAA: Ideal for military families

How to Lower Your Car Insurance Quote Under 25

- Maintain good grades: A GPA of 3.0+ can earn a discount

- Take a defensive driving course: Certified programs help

- Join a parent’s policy: Cheaper than a solo plan

- Drive a safe vehicle: Avoid sports or luxury cars

- Use usage-based apps: Track driving to earn savings

What You Need for a Car Insurance Quote

- Driver’s license

- Vehicle info (VIN, make, model)

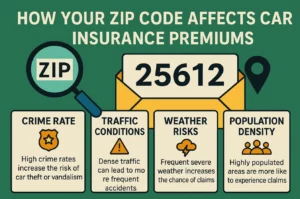

- ZIP code and current address

- Driving history (tickets, accidents)

- Past insurance (if any)

Final Thoughts

If you’re under 25, a high insurance quote isn’t the end of the road. With smart strategies and provider comparisons, you can still find a budget-friendly car insurance quote under 25 that works for you.

💡 Every year of safe driving helps lower your future premiums. Start now and stay covered smartly!