If you’re looking to compare quotes for luxury vs economy cars, your vehicle choice plays a big role in how much you’ll pay for insurance. It’s not just about the price of the car — insurers calculate risk in ways that may surprise you.

In this guide, we’ll show you exactly how to compare quotes for luxury vs economy cars — and what factors make the biggest difference in 2025.

Luxury vs Economy Cars: Why Insurance Quotes Vary

Insurance companies use detailed risk models to calculate premiums. The type of car you drive affects your quote due to:

- Repair and replacement costs — Luxury cars use high-end parts and tech

- Theft risk — Expensive vehicles are more likely to be targeted

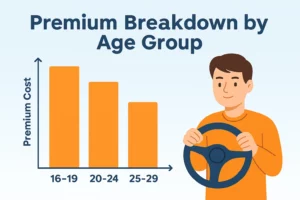

- Driver profile — Luxury cars often attract younger, higher-risk drivers

- Performance potential — More horsepower = more risk

- Safety features — Newer economy cars may come equipped with advanced driver-assist systems

Average Insurance Premiums (2025 Estimates)

- Luxury Car: $180–$350/month (Mercedes-Benz, BMW, Audi)

- Economy Car: $80–$130/month (Toyota Corolla, Honda Civic, Hyundai Elantra)

📌 Tip: Even if your luxury vehicle is financed, you may need higher limits and full coverage, which adds to cost.

How to Compare Quotes for Luxury vs Economy Cars Accurately

- Get quotes for identical coverage: Use the same liability limits, deductibles, and coverage types for both cars

- Include optional coverages: Add comprehensive, collision, roadside assistance, and uninsured motorist options for a true comparison

- Use the vehicle’s VIN: This ensures precise data for trim level and features

- Compare real-time quotes: Use trusted comparison tools like Insurance.com

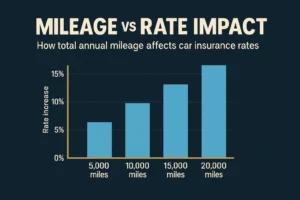

- Factor in usage: If the luxury car is a weekend cruiser and the economy car is your daily driver, the insurance needs will vary

Which Type of Car Is Cheaper to Insure?

Economy cars generally win on cost. They’re cheaper to repair, less likely to be stolen, and tend to be driven conservatively. However, some luxury models have surprisingly low premiums thanks to top-tier safety ratings and reliable security systems.

Luxury cars may qualify for loyalty, bundling, or low-mileage discounts, but they still come with a higher base rate — especially if they’re leased or financed.

Tips to Lower Insurance on Any Vehicle Type

- Bundle with home or renters insurance

- Use telematics (like Snapshot® or Drivewise®)

- Choose higher deductibles (if you can afford the risk)

- Maintain a clean driving record

- Ask about anti-theft and safety discounts

Final Thoughts

Comparing quotes for luxury vs economy cars is more than just a pricing game — it’s about understanding how insurers evaluate risk. Economy cars may be cheaper overall, but smart shopping, bundling, and safety features can narrow the gap.

No matter what you drive, take time to compare quotes for luxury vs economy cars to get the best possible rate — and that’s always a smart financial move.

Want to save even more? Explore our full guide on car insurance discounts.