Looking for the best personalized car insurance quotes in 2025? You’re not alone. No two drivers are alike — and your quote shouldn’t be either. Personalized quotes help you find the best possible rate based on your driving history, vehicle type, location, mileage, and more. But not all insurers are equally equipped to deliver accurate, tailored pricing.

In this guide, we’ll explore the top car insurance companies for customized quotes in 2025 — and why getting a quote that reflects your real risk profile matters more than ever.

Why Personalized Quotes Matter for Car Insurance

Personalized car insurance quotes are based on detailed information unique to you. This ensures that:

- ✅ You’re not overpaying for coverage you don’t need

- ✅ Discounts (like good student, low mileage, or safe driver) are applied

- ✅ You avoid bait-and-switch “teaser” rates

- ✅ You can compare policies on a true apples-to-apples basis

Generic estimates may look low at first glance, but often increase significantly once insurers learn more about you. That’s why choosing companies that specialize in real, tailored pricing is key.

Top 5 Auto Insurance Companies for Personalized Quotes

1. Progressive

Why it’s great: Progressive’s online system allows for detailed customization and shows real-time pricing updates as you adjust coverage. Their Snapshot® program adds further accuracy based on your driving behavior.

2. GEICO

Why it’s great: GEICO offers a fast quoting tool that asks key questions up front. It tailors quotes based on education, occupation, vehicle use, and more.

3. State Farm

Why it’s great: Through their Drive Safe & Save™ telematics program, State Farm creates dynamic quotes that evolve with your habits — especially helpful for safe, consistent drivers.

4. Allstate

Why it’s great: Allstate’s quote engine includes your prior claims history, vehicle safety features, and mileage. The Drivewise® program personalizes rates through driving data. Get a quote.

5. Nationwide

Why it’s great: Nationwide’s SmartRide® app helps drivers get quotes based on real behavior, not just age and ZIP code. It’s ideal for drivers with clean records and predictable routines.

What Makes a Car Insurance Quote Truly Personalized?

Personalized car insurance quotes typically ask for:

- 🚗 Vehicle details (make, model, year, VIN)

- 👤 Driver info (age, gender, marital status)

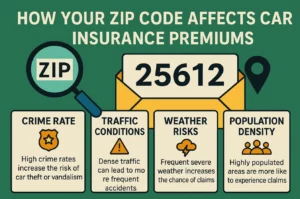

- 📍 ZIP code & garage location

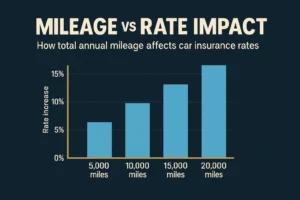

- 📅 Annual mileage & commuting distance

- 📄 Driving history (accidents, tickets, violations)

- 💳 Credit score (in most states)

- 🛡 Desired coverage types and limits

The more accurate your input, the better your pricing — and the more opportunities for discounts.

Tips to Get the Best Personalized Quote

- Be honest and complete with your information

- Compare at least 3–5 insurers side-by-side

- Use telematics if available for additional discounts

- Ask about bundling with renters, home, or life policies

- Review and update annually as your situation changes

Final Thoughts on Personalized Auto Quotes

Getting a personalized car insurance quote is no longer optional — it’s essential. The best insurers don’t just offer competitive prices; they give you pricing that reflects who you are and how you drive.

Start by comparing trusted providers like Progressive, GEICO, and State Farm, and see how much you can save when your quote truly fits you. For more tips, check our auto insurance guides.