Ever wondered why your friend pays less for car insurance — even if you drive similar vehicles? That’s because there are many factors that affect your car insurance quote, from your driving record to where you live. The more risk you represent, the higher your premium.

In this article, we’ll break down the most important factors that affect your car insurance quote — and how you can use this knowledge to save money in 2025 and beyond.

1. Driving Record

This is one of the biggest factors. If you have speeding tickets, accidents, or DUIs on your record, expect to pay more. Safe drivers are rewarded with lower rates, while high-risk drivers often face surcharges or limited coverage options.

💡 Tip: Most violations fall off your record after 3–5 years.

2. Age and Experience

Younger drivers — especially under 25 — are statistically more likely to get into accidents, which makes them more expensive to insure. On the other end, seniors over 70 may also see rate increases due to slower reaction times or health-related risks.

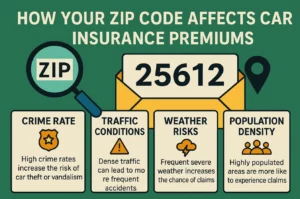

3. Location (ZIP Code)

Where you live plays a major role. High-crime areas, cities with heavy traffic, or regions prone to natural disasters tend to have higher premiums. Even moving to a new ZIP code within the same state can change your rate.

4. Vehicle Type

Insurers assess how safe, repairable, and theft-prone your car is. For example:

- Sports cars = higher rates

- Family sedans = moderate rates

- Vehicles with advanced safety features = discounted premiums

5. Coverage Level

Choosing full coverage (liability + collision + comprehensive) costs more than minimum state-required liability. However, it also offers broader protection — especially if your car is new, leased, or financed.

6. Credit Score (In Most States)

Yes, your credit matters. In many states, insurers use your credit score as a predictor of risk. A higher credit score can lead to lower rates, while poor credit may increase your premium.

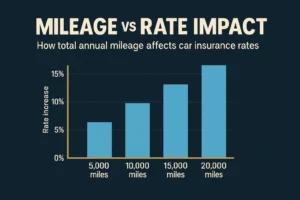

7. Annual Mileage

The more you drive, the more likely you are to be involved in an accident. Low-mileage drivers often qualify for discounts, especially if they drive under 7,500 miles per year.

8. Marital Status

Married drivers typically pay less than single drivers. Statistically, married individuals are involved in fewer accidents and are seen as more financially stable.

9. Insurance History

Never had insurance? Had a recent lapse in coverage? These can raise red flags for insurers and result in higher quotes. A continuous coverage history shows responsibility and can earn you loyalty discounts.

10. Deductibles and Limits

Choosing higher deductibles (like $1,000 instead of $500) lowers your monthly premium. However, make sure you can afford the out-of-pocket cost if you file a claim.

Understanding the Factors That Affect Your Car Insurance Quote

| Factor | Risk Level | Impact on Premium |

|---|---|---|

| Driving Record | High (with violations) | ⬆ Up to +40% |

| Age (under 25 / over 70) | Moderate to High | ⬆ +15–50% |

| Vehicle Type | Varies by model | ⬆ Sports cars / ⬇ Family sedans |

| ZIP Code | High in urban or high-theft areas | ⬆ +10–30% |

| Credit Score (in most states) | Moderate | ⬇ Excellent credit = savings |

| Annual Mileage | Moderate | ⬇ Low mileage = discounts |

| Insurance History | High (if lapsed) | ⬆ Gaps = surcharges |

| Coverage Level | Depends on plan | ⬆ Full coverage costs more |

As you’ve seen, these are the core factors that affect your car insurance quote. Each one plays a role in how much you pay monthly.

Bonus: Discounts and Programs

Even with all these factors, you can still save. Ask about:

- Safe driver discounts

- Bundling home and auto

- Telematics/usage-based programs

- Good student or senior savings

🚗 Compare Personalized Insurance Quotes

Ready to see what your actual rate could be? Enter your info once and get real quotes tailored to your age, ZIP code, vehicle, and driving history.

🔍 Get My Custom QuoteWant to learn how to get a truly accurate quote? Check out our guide on how to get accurate car insurance quotes.

Final Thoughts

Your car insurance quote isn’t random — it’s a reflection of dozens of data points. Understanding what insurers look at can help you take control of your rate, avoid surprises, and find the best deal for your unique situation.

Compare providers, update your details regularly, and take advantage of every possible discount to keep your premiums low and your coverage high. By understanding the factors that affect your car insurance quote, you can take steps to improve your situation and unlock better rates.