Wondering how your ZIP code affects car insurance premiums? You might be surprised to learn that just moving a few blocks can raise or lower your rates. That’s because location is a major factor in how much you pay for auto insurance.

In this article, we’ll explain how your ZIP code impacts car insurance pricing, which local factors influence your rate, and how to compare quotes based on your location — so you can make smarter, more affordable choices. Want to learn more about what affects your premium? Check out our guide on key car insurance pricing factors.

Why Your ZIP Code Affects Car Insurance Premiums

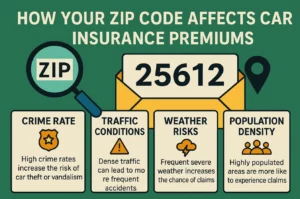

Insurance is all about risk — and where you live affects that risk more than you might think. Insurance companies closely analyze how ZIP code impacts car insurance premiums because location-based risks play a big role in determining rates. Even if you’re a safe driver, your premium can go up simply because of your neighborhood’s statistics.

Key ZIP Code Factors That Affect Insurance Rates

- Traffic density: Areas with heavy congestion mean more accidents

- Theft & vandalism rates: High-crime ZIP codes usually mean higher premiums

- Accident frequency: Local crash rates directly impact pricing

- Uninsured drivers: Areas with many uninsured motorists lead to higher costs

- Weather risks: Floods, hail, and storms can raise rates in your ZIP

- Litigation rates: ZIP codes with high claim payouts or lawsuits may cost more

📌 Example: A driver in suburban Kansas may pay far less than a similar driver in downtown Los Angeles — even with the same car, age, and driving history.

States That Regulate ZIP Code-Based Pricing

In most U.S. states, insurers are allowed to factor in ZIP code when calculating rates. However, some states — like California, Michigan, and Massachusetts — have begun regulating or limiting the influence of geographic data to reduce inequality in pricing.

How to Save on Insurance in a High-Risk ZIP Code

- Shop around: Some insurers weigh ZIP code less than others

- Use telematics: Driving behavior programs like Drivewise® or SmartRide® can offset geographic risk

- Garage your vehicle: Secured parking may qualify you for lower rates

- Bundle policies: Combine auto + home/renters insurance for discounts

- Increase deductibles: Raising your deductible can reduce your monthly premium

Best Tools to Compare ZIP Code-Based Quotes

- The Zebra: Easy side-by-side comparisons by ZIP code

- Compare.com: Shows how rates change by neighborhood

- Insurify: Smart quote engine with local data integration

- Policygenius: Combines location with policy-level customization

Final Thoughts on ZIP Code and Car Insurance

Your driving habits matter — but so does your ZIP code. From crime to congestion to climate, insurers take dozens of location-specific variables into account when pricing your policy.

If you’re wondering how your ZIP code affects car insurance premiums, remember to compare quotes regularly and explore all available discounts. With the right tools and providers, you can still find competitive rates — no matter where you live.